The U.S. and Mexico have never been more economically linked. From auto parts to avocados, the two countries share deep trade ties. But perhaps nothing symbolizes their connection more than beer.

For now, though, beer drinkers can breathe a sigh of relief—at least temporarily. The much-talked-about tariffs on Mexican goods have been put on hold. On Monday, President Trump and Mexican President Claudia Sheinbaum announced a deal to delay the planned 25% tariffs for at least a month while both sides work out an agreement. That news sent Wall Street into a tailspin in the morning, with stocks diving as investors panicked over what tariffs could mean for trade. But by the afternoon, many stocks had regained ground as the market recalibrated.

And few companies had a wilder ride than Constellation Brands (STZ), the parent company of household-name beers like Modelo, Corona, and Pacifico in the U.S. When the market opened, its stock plunged more than 7%, only to recover most of those losses by the afternoon.

Let’s break it down: If the tariffs go into effect, Constellation Brands would have to pay a 25% fee on every keg and case of Modelo, Corona, and Pacifico it imports from Mexico to the U.S. That’s a steep cost increase, and like any business, they wouldn’t just absorb it out of the goodness of their hearts. That extra cost would get passed along to consumers.

And it’s not just the U.S. applying pressure. Mexico has its own response lined up, threatening to impose tariffs on American barley, a key ingredient in brewing beer. If both countries go through with their respective tariff threats, the price of your favorite Mexican lager could climb.

Thankfully, no. Just because a 25% tariff is imposed on imports doesn’t mean prices on shelves will jump by 25%. Several factors help soften the impact. First, the mere threat of tariffs has already weakened the Mexican peso and Canadian dollar against the U.S. dollar, making imports slightly cheaper for American businesses. Second, beer companies don’t run on a week-to-week supply chain.

According to Bump Williams, a consultant in the beer industry, major distributors for Constellation Brands and Heineken (which owns Dos Equis and Tecate) usually keep a 90 to 120-day inventory. That means the beer you’ll be drinking this month and next has already been purchased under existing pricing, meaning immediate price hikes are unlikely.

But if tariffs do kick in and stay in place for the long run, Williams estimates we could see beer prices rise between 5% and 7%. A six-pack that usually sells for $12 could creep up to around $12.84—not a backbreaking increase, but enough to add up over time.

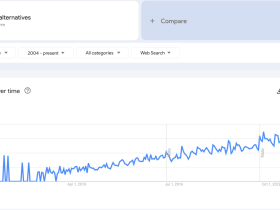

Beer isn’t the only alcoholic beverage that could feel the pinch. The U.S. spirits market, particularly tequila and mezcal, is also deeply tied to Mexico. In 2024, tequila and mezcal accounted for 32.2 million 9-liter cases in sales across different price segments, making it one of the fastest-growing categories in the industry. While tequila and mezcal saw an overall growth of 2.0%, the premium and super-premium segments were the strongest performers, reinforcing consumer preference for high-end products.

Meanwhile, the U.S. spirits industry generated $ 37 billion in revenue in 2024, with tequila and mezcal contributing a significant $6.7 billion. These figures illustrate just how much Mexican spirits contribute to the American beverage market and why potential tariffs could ripple across the industry. If trade tensions escalate, premium tequila brands like Patron, Casamigos, and Don Julio could see price hikes similar to what’s expected for beer, impacting bars, restaurants, and everyday consumers.

Beyond beer, tariffs on Mexican goods would have wide-ranging effects on the U.S. economy. The auto industry, which is deeply integrated with Mexico, would face major disruptions. The price of popular Mexican food staples—think avocados, mangoes, and tequila—could all rise. And the ongoing trade uncertainty isn’t exactly great for consumer confidence.

Williams believes that when push comes to shove, the Trump administration might reconsider slapping the full 25% tariff on beer. “I have faith that the Trump administration will dial back the tariff percentage on beer when he sees how many blue- and white-collar voters he’s impacting with an ‘I win, you lose’ position,” he said. “After all, he proclaimed to be a man of the people, by the people, and for the people.”

For now, we wait. The U.S. and Mexico have a month to iron out a deal, and in the meantime, beer prices remain stable. But if negotiations stall and tariffs go into effect, you might start seeing some changes at the checkout counter.

One thing’s for sure: If tariffs do hit, Americans might find themselves reaching for more domestic brews—or simply swallowing the price hike and continuing to crack open a cold Modelo. Either way, this story is far from over.

So, enjoy that six-pack while it’s still at a reasonable price. The beer trade war is on pause—but it’s not over yet.