While Tom Holland has been making headlines for his engagement to Zendaya, the actor has also been quietly scaling up the distribution of his premium non-alcoholic beer brand, Bero.

Just three months after launching, the direct-to-consumer (DTC) brand has expanded its reach by selling on Amazon, a move that was in the works for over six months. Bero’s VP of Digital and E-Commerce, Cécile Peters, told Retail Brew that Amazon approached the brand, inviting it to join its exclusive wholesale platform, Vendor Central.

A Strategic Move Amid Shifting DTC Trends

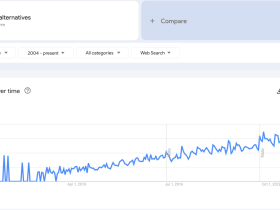

Bero’s entry into Amazon follows a broader trend of DTC brands seeking additional distribution channels. As venture capital funding has become scarcer, many brands have turned to platforms like Amazon to sustain growth.

According to Andrew Lipsman, an independent analyst at Media, Ads + Commerce, Amazon has become “a possible lifeline” for DTC brands looking to drive sales.

“There’s always a tradeoff between margin and sales volume, so DTC brands that opt for selling on Amazon go in eyes wide open,” Lipsman told Retail Brew. “But Amazon could be great for growing the brand, especially because that’s where people search for niche products that satisfy specific customer needs—in this case, non-alcoholic beer.”

Why Amazon?

Despite Amazon’s crowded marketplace, Peters said the platform aligns well with Bero’s strategy. With the brand already available in nearly 3,000 retail stores nationwide, Amazon offers another powerful sales channel, particularly given its dominance in online grocery sales, logistics infrastructure, and access to over 200 million Prime members.

“It’s like the biggest discoverability platform when it comes to grocery items,” Peters said. “I think 54% of consumer searches for products are on the Amazon platform, not on Google.”

She also noted that fast shipping and seamless fulfillment through Amazon make sense for a beverage brand, given the logistical challenges of shipping drinks.

Premium Positioning Over Discounts

Bero’s Amazon presence isn’t about price competition. Instead, Peters emphasized that the brand is prioritizing customer loyalty and brand building over aggressive discounting.

“We are a premium brand, so we’re not overly focused on discounting,” she said. “But we’re focused on building loyalty and consumer retention.”

Bero has also expanded to Instacart, further reinforcing its focus on instant delivery as a key strategy.

For Holland, Bero Is Personal

For Holland, Bero isn’t just a business venture—it’s rooted in his personal lifestyle. Peters shared that the actor was inspired to create the brand as a high-quality, flavorful alternative for those looking to cut back on alcohol or maintain sobriety.

As founder, Holland remains focused on the consumer experience.

“He wants to know, ‘High-level, how is the brand tracking?’” Peters said. “But what is more important to him is, ‘What is the consumer feedback like? How are consumers liking this?’”

With a long-term vision for Bero, Holland appears to be taking a thoughtful approach to scaling the brand—one strategic move at a time.